CFOs help business owners make sound business decisions utilizing cash flow management, forecasting, and strategic planning.

The biggest benefit of a virtual CFO is top-level expertise without the sizable cost

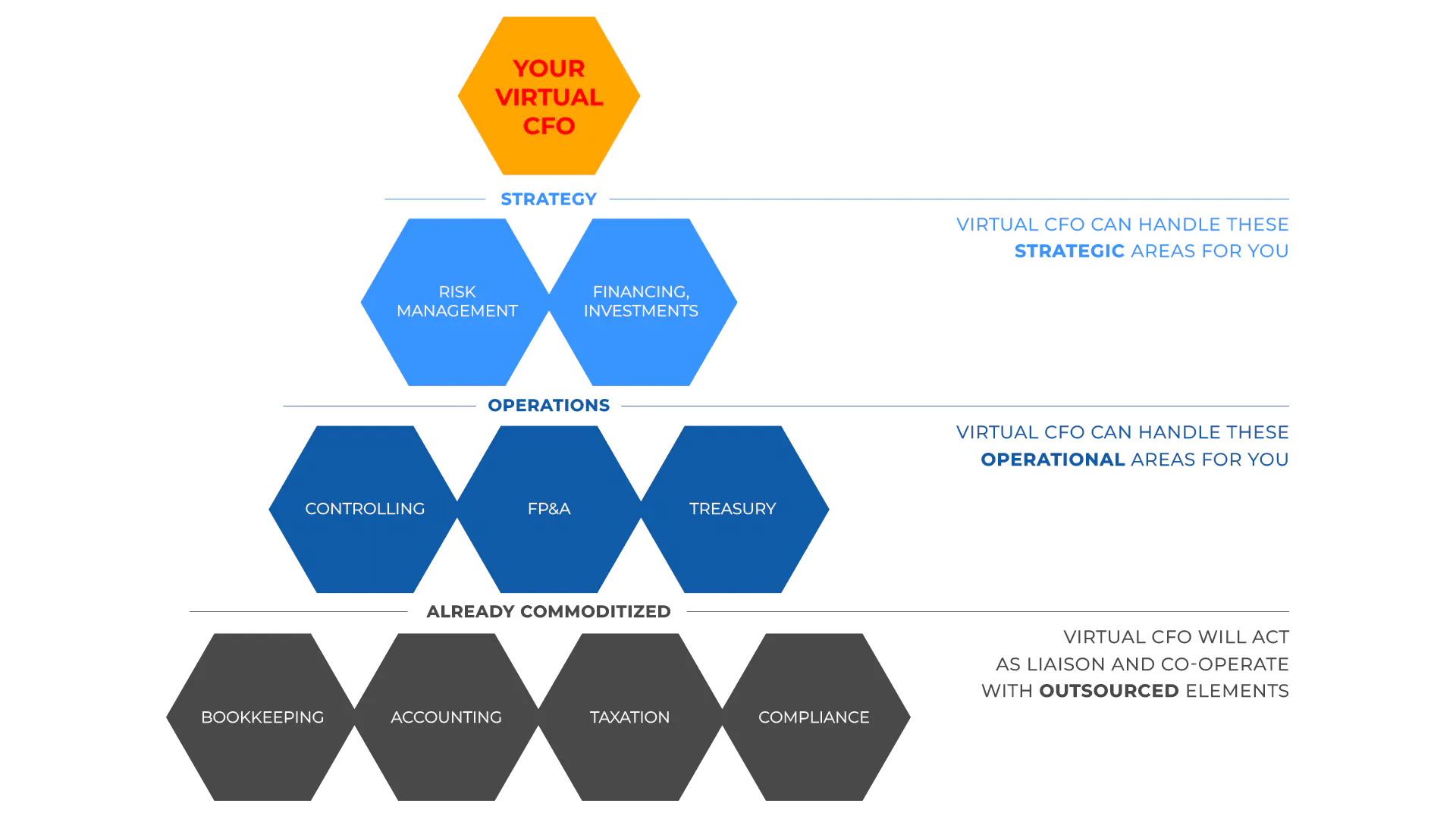

Your virtual CFO

Financial Strategy

As you grow, your business becomes more complex, operations and finances get harder to manage and will dominate more of your time

Financial Systems and Design

Rapid growth can endanger your cash flow. A virtual CFO can help you navigate periods of accelerated growth and implement systems for the next phase of your business

Budgeting and Forecasting

A virtual CFO shows you how to find and exploit new opportunities while budgeting responsibly during economic instability

Get started with a virtual CFO

Virtual CFO Today

Virtual CFO is a real and very experienced finance person who can help guide the way.

Take the first step by exploring what virtual CFO services are all about.

I hereby thank the advisor for supporting us in strategic financial planning, risk management and dealing with investors. Our ongoing co-operation with the Virtual CFO service is focused on international expansion and we look forward to succeeding together again in the next rounds of funding.

PalmApp.com

How much does virtual CFO cost?

Affordable monthly packages or hourly billing plans.

You do not need to have a full-time CFO.

We are here when you need us to be.

Hiring a virtual CFO lets you control costs by getting only the services you need, when you need them.

Your virtual CFO becomes your best resource for cutting costs within your business.

Also remember that the usual hiring process will never offer as fast reaction to specific projects or situations as the “CFO as a service”.

Virtual CFO services help you navigate different growth phases

Are you a first-time startupist with only a vague understanding of corporate finance?

Reach out to us and we will have your back.

Are you a veteran entrepreneur who needed a DD & valuation in a competitor acquisition case yesterday?

Don’t worry, we can get into it ASAP.

Our Services

Virtual CFO Allows you to see the BIG picture

We provide top-quality financial services in the fields of preparing for a fund raising, developing business plans, implementing systems and processes, implementing budgeting systems, comprehensive financial health check-ups, due diligence, cash flow planning, cost management, tax planning, exit strategy, investor relations, turnaround management, and many more…

Financial Planning

You can't manage your business without a sound financial plan. It reflects your vision and shows your cash flow.

Financial Analysis

How do your assets perform? Do you have an optimal capital structure? Sufficient funding? How is your rentability? Is the trend positive? What can be improved?

Risk Management

No business is without element of risk. Identify, quantify and manage your risk. Do not take unnecessary risk, be ready for undesired outcome and have reserves to get you over any headwinds.

Controlling

We will monitor the progress towards your business goals, point out any deviations and indicate corrective action to get you back on track.

Corporate Governance

Our seasoned experts can provide board level guidance and gravitas as they have done before.

Startup Financing

Let us help you deal with investors and banks. Don't accept sub-market term sheets and dirty tricks which will harm you in the future..

M&A

Buy-side or sell-side transactions will benefit from our many years of transaction experience. DDs, valuations, data rooms, complicated cross-border deals are our bread and butter.

IPO

If you are going public and need to temporarily boost your team to work alongside your investment bankers, call us. We have done numerous deals in the US market (alongside SPACs, PIPEs etc.).

Pricing

Best rates for senior-level experts

Actual price depends on the complexity of your business and the frequency of communication that you require

We offer competitive hourly & daily rates, fixed-price projects and discounted service packages, such as:

Startup

SME

Other

Value package for setting up all systems to get you started: financial plan, controlling, reporting, document workflow, approvals etc.

Significant overhaul of existing financial systems, financial strategy and operations, FP&A modelling of future scenarios, risk management.

Special projects and more advanced forms of corporate finance (M&As, fundraising…), corporate recovery and restructuring.

Contact us and we will find a solution fitting both your needs and budget

Virtual CFO does not need stock options, paid holiday, paid medical leave or a company car, life insurance etc.

When we raised €2.5M in a strategic Series-A round of VC funding, we had used an advisor who has recently co-founded the Virtual CFO service. So, we turned to him again with confidence when building our current startup Intellmaps, and the service has worked out great.

Intellmaps.com

Feel free to reach out to us if you need to speak with our references matching your project or area of need.

How does it work?

It is quite common for virtual CFOs to have video conferences on platforms such as Zoom on a weekly or monthly basis, depending on your business’ needs and budget. This makes a virtual CFO a lot more affordable than a full-time CFO and also cost-effective. Unlike a CPA or controller, a virtual CFO goes beyond tactical advice and provides strategic guidance. We will also liaise with your bookkeepers, accountants, controllers, payroll, tax experts, legal counsel, auditors and investors when needed.

Read our Virtual CFO Whitepaper

This will provide you with an idea how to effectively establish a solid relation with your virtual CFO and get the most out of it.

New direction in a global, high-inflation environment

Think about your remote CFO as your gym buddy, tour guide and bodyguard… not a boring bully or a sadistic dentist.

It was necessary to analyze the situation in a very short time, to carry out a thorough analysis of receivables and payables by a third-party advisor, to create a new financial plan corresponding to the current market conditions (both high inflation and interest rates), including a capital investment plan, and to prepare the documentation for negotiations with the financial investor and the continuation of good relationship with the bank.

The Virtual CFO service provided speed and expertise that would otherwise be hard to find in the market.

FAQ

Nope. Virtual CFO as a service means zero recruitment fees, no vendor lock-in and immediate start.

Usually within 48 hours, depending on how quickly we reach our agreement.

Fair point. Trust needs to be earned over time. As first step, feel free to reach out to our references – real entrepreneurs, with real companies. They will assure you their experience went smoothly. Also, for many tasks, such as research or analytics, we may not need your financial statements or bank account data at all. It’s also good to consider that most of fraud and cyber security attacks are performed by in-house employees, not outside sources. Just because you or your HR selected a candidate after several rounds of in-person interviews does not actually bring any guarantees that they won’t defraud you or sell your sensitive data to competitors when you think about it. Flawless reputation is our goal.

We understand. Personal connection is in many cases preferable to video calls. But technology provides some advantages: no geographic or time zone constraints, lower cost, higher speed & flexibility, and even health safety. Our calls can have strong end-to-end encryption. Besides, you probably already have outsourced your bookkeeping, payroll and taxes and this will not be your first experience with remote service…

Absolutely. This is quite a popular request because lawyers rarely assist with the commercial terms of transactions.

Why not? If you only need a few hours of our time then that is the amount you will get. And of course, if you scale in the future, we can provide more assistance later.

Almost all work is done by us, only in very specific cases, where niche expert know-how is required (intangible assets valuation, debt collection, reorganization etc.), we might bring along extra talent, subject to your prior approval of any such co-operation.

Don’t worry, any information shared with us will be treated with utmost privacy and NDA is standard part of our contract.

We will do you one better: we can create a tailored package of services just for you and work on an affordable retainer. Soon you should see your bottom line improve!

Yes, of course. Unlike full-time in-house employees who often hide or ignore problem areas and almost never challenge the CEO or founder, we operate on honesty and transparency. That pushes your business towards the goals and brings clarity.

No problem, send us an email or book your free Discovery call. Talk directly to a Virtual CFO and discover how to get what you really want from your business.

We will help you see the information you need in time, while remaining agile, with minimum overhead.